Draft amendments to the Statute for Industrial Innovation

- Publication Date :

- Last updated:2023-02-02

- View count:455

Taiwan holds a vital and leading position in the global semiconductor supply chain, a fact which has been thrown into sharper relief during the last few years by the escalating U.S.-China trade war and a succession of major global events disrupting supply chain operations, resulting in a severe global shortage of chips. These events have caused various countries to become acutely aware of the necessity to develop their own domestic semiconductor capability and provide their key industries with enormous subsidies or expanded tax incentives to reduce reliance on external supply chains. These developments will impact Taiwan's existing position within the global semiconductor supply chain.

Faced with the challenge of various nations vying to develop semiconductor industries of their own, the government has been supporting semiconductor firms' continued development within Taiwan and providing policy incentives to attract major international firms in semiconductor fabrication, equipment and materials to invest in the nation. As an additional measure, the Executive Yuan approved draft amendments to the Statute for Industrial Innovation on November 17. The amendments will provide historically high tax credits to domestic companies engaged in technological innovation that also occupy a key position in international supply chains, to encourage continued investment in developing cutting-edge innovative technologies and sustained purchasing of advanced manufacturing process equipment. This will in turn strengthen the resilience of the nation's industrial supply chains and capitalize on Taiwan's existing competitive advantages, consolidating and elevating the status of Taiwan's key national industries within the global supply chain.

Major provisions of the draft amendments

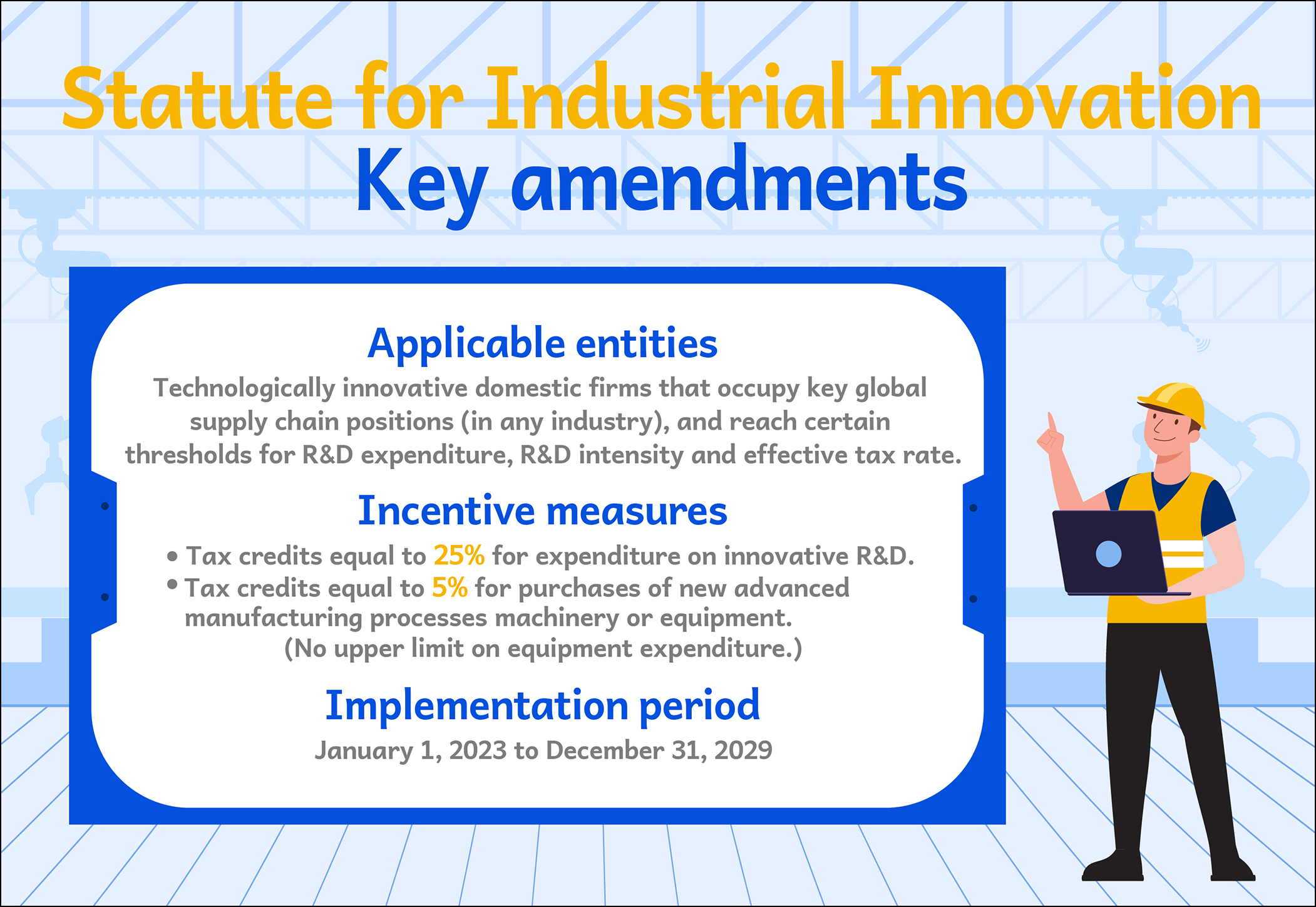

■ Applicable entities: Domestic companies engaged in technological innovation that also occupy a key position in international supply chains, with their R&D expenditures and intensity reaching a certain scale and effective tax rate reaching a certain ratio.

■ Incentive measures: Provide tax credits at a rate of 25% for expenditure in cutting-edge, innovative R&D, offset against the amount payable for the current year in profit-seeking enterprise income tax. Provide tax credits at a rate of 5% for new machinery or equipment purchased for use in advanced manufacturing processes, offset against the amount payable for the current year in profit-seeking enterprise income tax, with no upper limit on machinery and equipment expenditure.

■ Implementation period: January 1, 2023 to December 31, 2029.